Exness Account Types

Exness, a renowned forex and CFD broker, acknowledges the diverse needs and preferences of traders. To meet these varied requirements, Exness offers a range of account types tailored to different trading styles, experience levels, and investment objectives. Selecting the appropriate account type is vital, as it can profoundly influence your trading experience, strategy execution, and potential profitability.

Each Exness account type is accompanied by distinct conditions, such as variations in spreads, leverage, minimum deposits, and commission structures. This array of options empowers traders to choose the account type that most closely aligns with their trading strategy and financial aspirations.

Overview of Exness Account Types

Exness offers a variety of account types to cater to the diverse needs and strategies of traders. Each account type is designed with specific features to accommodate different levels of trading experience, capital investment, and trading objectives. Here, we provide an overview of the primary Exness account types available, highlighting their key features and the potential target audience for each.

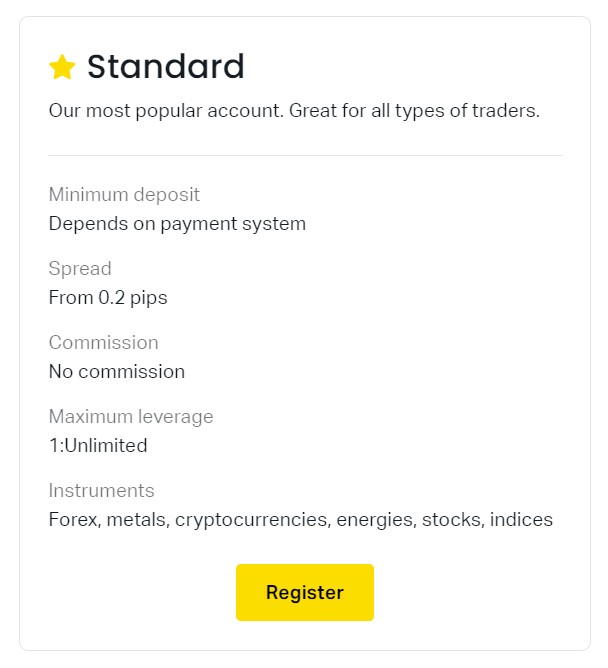

- Standard Accounts:

These accounts are well-suited for beginners or traders who prefer simplicity and ease of use. Standard accounts usually offer a wider range of tradable instruments with no commission on trades, making them accessible and straightforward. They typically feature higher spreads compared to professional accounts but do not require a large minimum deposit, allowing traders to start with smaller capital.

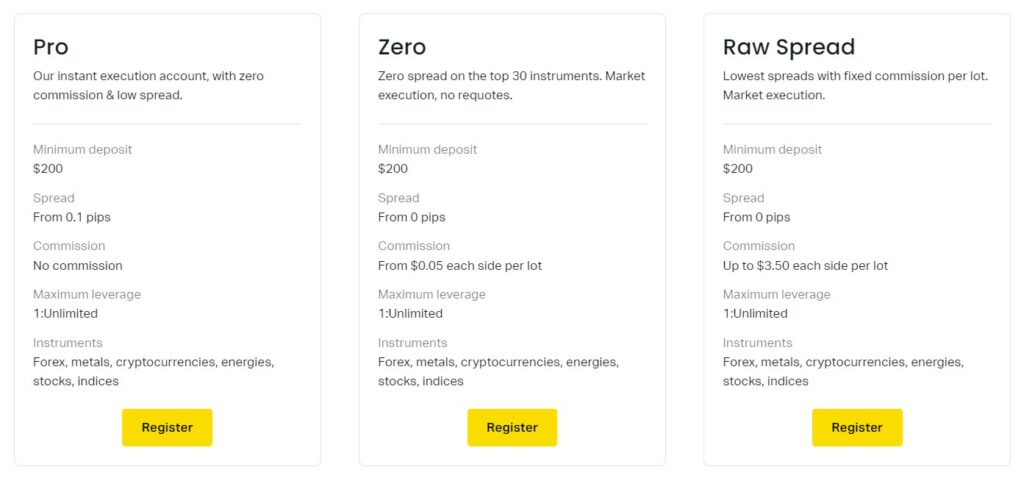

- Professional Accounts:

Designed for more experienced traders, professional accounts offer more competitive conditions, including lower spreads and higher leverage options. These accounts are further categorized into various types that include:

- Raw Spread: Ideal for scalpers and high-volume traders, the Raw Spread account offers tight spreads starting from 0.0 pips. Traders pay a commission for the trades, but they benefit from the raw market spreads.

- Zero: This account type is tailored for traders who seek zero or near-zero spreads on major currency pairs. It typically involves a commission per trade and is popular among day traders and those who employ automated trading strategies.

- Pro: The Pro account is a versatile option that combines competitive spreads without commissions, making it suitable for a broad range of traders, including swing traders and position traders.

- Demo Accounts:

Besides the live trading accounts, Exness also provides demo accounts, which are crucial for beginners and experienced traders alike. Demo accounts offer a risk-free environment to practice trading strategies, get familiar with the platform, and test the services provided by Exness without using real money.

Each account type at Exness is designed to provide specific advantages to different types of traders, taking into account their trading style, risk tolerance, and capital availability. Understanding the distinctive features of each account can help traders select the one that best fits their trading needs and goals, enhancing their overall trading experience with Exness.

Standard Accounts at Exness

Standard Accounts at Exness are tailored to cater to a broad spectrum of traders, particularly appealing to beginners and those who prefer a straightforward trading approach. These accounts are designed to offer simplicity and accessibility, providing a user-friendly interface and easy-to-understand trading conditions. Here’s an in-depth look at the key features and benefits of Exness Standard Accounts:

- Accessibility: One of the main advantages of Standard Accounts is their low barrier to entry. They typically require a minimal initial deposit, making them accessible to traders with varying levels of capital. This feature is especially beneficial for new traders or those who wish to start trading with a smaller investment.

- No Commission: Standard Accounts usually operate without any commission fees on trades. This means that traders do not have to pay any additional costs on the trades they execute, which is ideal for those who prefer a clear and straightforward cost structure.

- Spreads: While the spreads in Standard Accounts are generally higher compared to those in Professional Accounts, they remain competitive. The spread structure is designed to be transparent, enabling traders to understand and calculate their trading costs easily.

- Leverage: Exness offers flexible leverage options, which can be particularly advantageous for Standard Account holders. Traders can choose the leverage that best suits their trading style and risk tolerance, enhancing their potential to maximize profits.

- Trading Instruments: Traders with Standard Accounts have access to a wide range of trading instruments, including forex pairs, metals, cryptocurrencies, energies, and indices. This variety allows traders to diversify their portfolios and explore different markets.

- Trading Platforms: Exness provides access to popular trading platforms like MetaTrader 4 and MetaTrader 5, ensuring that Standard Account holders can utilize powerful trading tools and resources to analyze the markets and execute their trades.

- Support and Resources: Standard Account users benefit from Exness’s comprehensive support and educational resources. This includes 24/7 customer support, access to market analysis, educational materials, and trading tools to help traders make informed decisions.

Professional Accounts at Exness

Exness Professional Accounts are designed for more experienced traders who seek advanced features and competitive trading conditions. These accounts offer lower spreads and access to a broader range of trading instruments, along with more sophisticated trading tools.

| Feature | Raw Spread Account | Zero Account | Pro Account |

| Spreads | From 0.0 pips | Ultra-low, near zero | Low, but not zero |

| Commissions | Yes (lower than standard) | Yes | No commission |

| Minimum Deposit | Varies by region | Varies by region | Varies by region |

| Leverage | High, flexible | High, flexible | High, flexible |

| Trading Instruments | Extensive range available | Extensive range available | Extensive range available |

| Execution Speed | Fast | Faster | Standard |

| Trading Platforms | MT4, MT5 | MT4, MT5 | MT4, MT5 |

| Account Management | Advanced tools available | Advanced tools available | Advanced tools available |

| Ideal for | Scalpers, high-frequency | Day traders, EA users | Swing traders, long-term |

Key Benefits of Professional Accounts:

- Advanced Trading Tools: Access to more sophisticated trading tools and platforms, catering to complex strategies and analysis.

- Priority Support: Enhanced customer support, often with dedicated account managers and faster response times.

- Customization: Greater flexibility in account settings, allowing traders to tailor their trading environment to their specific needs.

Who Should Consider Professional Accounts?:

- Experienced traders who require tight spreads and a more extensive range of trading instruments.

- Traders who employ detailed strategies that benefit from better trading conditions such as lower latency and faster execution.

- Individuals looking for a more professional trading environment with the ability to use advanced tools and resources.

Comparison of Exness Account Types

Here’s a detailed comparison of the key features across different Exness account types to help traders choose the one that best fits their trading preferences and strategies:

| Feature/Account Type | Standard Account | Raw Spread Account | Zero Account | Pro Account |

| Spreads | Higher compared to professional accounts | From 0.0 pips | Ultra-low, near zero | Low, but not zero |

| Commissions | No commission | Yes, lower than standard | Yes | No commission |

| Minimum Deposit | Generally lower | Varies by region | Varies by region | Varies by region |

| Leverage | Flexible, up to specified limits | High, flexible | High, flexible | High, flexible |

| Trading Instruments | Wide range, including forex, metals, etc. | Extensive range available | Extensive range available | Extensive range available |

| Execution Type | Market execution | Market execution | Market execution | Market execution |

| Trading Platforms | MT4, MT5 | MT4, MT5 | MT4, MT5 | MT4, MT5 |

| Account Currency Options | Multiple options | Multiple options | Multiple options | Multiple options |

| Trading Strategies | Suitable for a variety of strategies | Best for scalping and high-frequency trading | Ideal for day traders and EA users | Suitable for swing and long-term strategies |

| Educational and Analytical Tools | Available | Available | Available | Available |

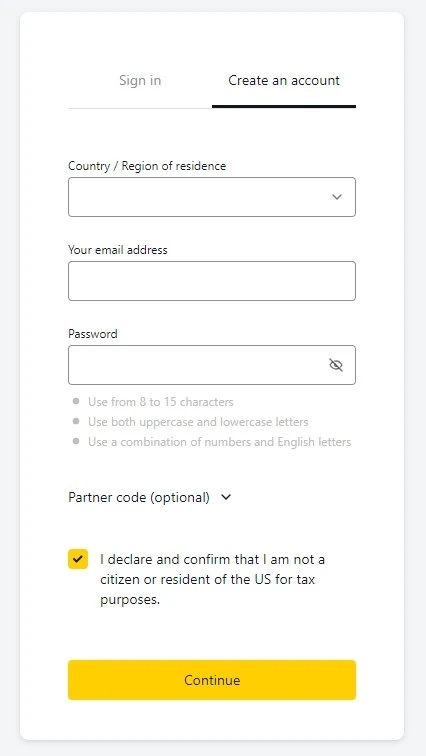

Exness Account Opening Process

Opening an account with Exness is a streamlined and user-friendly process designed to get traders set up and ready to trade as quickly as possible. Here’s a step-by-step guide to opening an Exness account:

- Registration:

- Visit the Exness website and locate the “Open an Account” button.

- Provide your email address and set a password, or register using an existing Google or Facebook account for quicker access.

- Account Verification:

- To comply with regulatory requirements, you will need to verify your identity and residence. This typically involves uploading a government-issued ID (passport, driver’s license, etc.) and a proof of residence document (utility bill, bank statement).

- The verification process may take some time as the documents need to be reviewed by the Exness team for approval.

- Choosing Account Type:

- Once your account is verified, select the account type you wish to open. You can choose from Standard, Raw Spread, Zero, or Pro accounts based on your trading preferences.

- Consider the key features of each account type, such as spreads, commissions, and minimum deposits, to decide which best suits your trading style.

- Setting Up Your Trading Platform:

- Download and install the trading platform you prefer, such as MetaTrader 4 or MetaTrader 5, available directly from the Exness website.

- Configure your platform by logging in with the credentials provided by Exness. You can also customize your trading environment with tools and indicators as needed.

- Making a Deposit:

- Fund your account using one of the several deposit methods offered by Exness. These can include bank transfers, credit/debit cards, and various e-wallets.

- Check for any minimum deposit requirements based on your chosen account type and ensure your initial deposit meets or exceeds this amount.

- Demo Account:

- If you’re new to trading or wish to practice strategies without financial risk, consider opening a demo account alongside your live account.

- The demo account allows you to trade in a simulated environment with virtual funds, providing a valuable learning experience.

- Start Trading:

- With your account set up and funded, you can begin trading. Monitor the markets, execute trades, and manage your portfolio using the tools and resources provided by Exness.

- Ongoing Support:

- Exness offers continuous customer support and educational resources. Utilize these to enhance your trading skills and stay informed about market conditions.

Opening an account with Exness is designed to be a straightforward process, ensuring traders can quickly access the financial markets. Always consider your trading objectives and risk tolerance when selecting an account type and initiating trading activities.

Choosing Right Type of Exness Account

Choosing the right Exness account type is crucial for aligning with your trading strategies, experience level, and financial goals. Exness offers various account types, each designed to cater to different trader needs, from beginners to seasoned professionals. Here’s a guide to help you select the Exness account that best suits your trading style:

Assess Your Trading Experience:

- Standard Accounts: Ideal for beginners or those who prefer a straightforward trading experience. These accounts typically offer higher spreads but no commissions, making them simple to manage.

- Professional Accounts (Pro, Raw Spread, Zero): Suited for experienced traders who require tight spreads and more sophisticated trading conditions.

Consider Your Trading Strategy:

- Scalping: If you prefer scalping, the Raw Spread or Zero accounts with lower spreads and commission-based pricing can be more beneficial.

- Swing or Position Trading: The Pro account, with its no-commission structure, might be more suited for traders holding positions for longer periods.

Evaluate Financial Commitment:

Check the minimum deposit requirements for each account type. Pro accounts might require a higher initial deposit compared to Standard accounts.

Trading Volume and Frequency:

- High-volume traders can benefit from accounts like Raw Spread or Zero, where the trading costs can be minimized despite the commission due to tighter spreads.

- Occasional traders might prefer the simplicity of a Pro or Standard account, which, while having slightly wider spreads, don’t include additional commission fees.

Platform Compatibility:

Ensure the account type you choose is compatible with your preferred trading platform, whether it’s MetaTrader 4 or MetaTrader 5.

Leverage Needs:

Consider the leverage options available with each account type. While higher leverage can increase profit potential, it also raises the risk, so it should align with your risk management strategy.

Access to Trading Instruments:

Make sure the account type you choose offers access to the trading instruments you’re interested in, whether it’s forex, commodities, indices, or cryptocurrencies.

Customer Support and Resources:

Professional account types like Pro, Raw Spread, and Zero may offer more robust support and additional resources, which can be a deciding factor for some traders.

Demo Accounts at Exness

Demo accounts play a crucial role in the trading journey, especially for beginners and traders looking to test new strategies without financial risk. Exness provides demo accounts that closely simulate real trading environments, allowing users to gain valuable experience and insights. Here’s an overview of the features and benefits of Exness Demo Accounts:

- Risk-Free Trading Environment: Demo accounts offer a safe platform for traders to practice trades and strategies without risking real money. This feature is particularly beneficial for beginners to learn trading basics and for experienced traders to experiment with new strategies.

- Real Market Conditions: Exness Demo Accounts replicate real market conditions, providing users with a realistic trading experience. Traders can observe how market events and conditions affect their trades and practice responding to various market scenarios.

- Access to Trading Platforms: Users can access popular trading platforms like MetaTrader 4 and MetaTrader 5 with their demo accounts. This access allows traders to familiarize themselves with the platforms’ features, tools, and functionalities.

- Virtual Funds: Demo accounts are funded with virtual money, enabling traders to execute trades, test strategies, and understand the market dynamics without financial risk.

- Experimentation with Different Account Types: Traders can set up demo accounts that mimic the different real account types offered by Exness, such as Standard, Raw Spread, Zero, and Pro accounts. This variety helps users understand the nuances of each account type and choose the one that best suits their trading style.

- Educational Resource: Demo accounts serve as an excellent educational tool. Traders can use them in conjunction with educational materials provided by Exness to enhance their trading knowledge and skills.

- No Time Limit: Exness typically does not impose a time limit on how long traders can use their demo accounts, allowing for continuous practice and learning. However, traders should check if there are any specific conditions or inactivity rules associated with their demo accounts.

- Strategy Testing and Optimization: Traders can use demo accounts to test new trading strategies and optimize existing ones without risking their capital. This testing is crucial for developing a consistent and potentially profitable trading approach.

Conclusion

Exness offers a diverse range of account types to suit traders across various experience levels and strategies. From Standard Accounts, ideal for beginners with lower minimum deposits and no commissions, to Professional Accounts like Raw Spread and Zero with lower spreads and advanced features, Exness provides tailored solutions to enhance your trading experience.

Demo Accounts are also available, offering a risk-free platform for practice regardless of experience level. Choosing the right account type is crucial, aligning with your strategy and risk tolerance. With Exness, whether you’re a novice or seasoned trader, there’s an account type to meet your needs, supported by educational resources and demo accounts for skill development and confidence-building.

Can I switch between different Exness account types?

Yes, Exness allows you to open multiple account types and switch between them based on your trading needs. However, you cannot change the account type once it's created; instead, you can open a new account with your desired type.

Is there a minimum deposit required for Exness accounts?

The minimum deposit varies depending on the account type. Standard accounts usually have lower minimum deposit requirements than Professional accounts. It's best to check the specific requirements for the account type you're interested in on the Exness website.

How do I open a Demo account with Exness?

You can open a Demo account by registering on the Exness website. Select the demo account option during the registration process, and you'll receive virtual funds to practice trading without financial risk.

Are there any restrictions on trading strategies with Exness accounts?

Exness allows various trading strategies, but it's crucial to check the terms for each account type as some strategies might be more suited to specific account types. For instance, scalping and high-frequency trading are ideal for Raw Spread accounts.

How does leverage work with Exness accounts?

Leverage allows you to trade larger positions than your current capital would permit. The available leverage varies by account type and is subject to regulatory constraints. Always use leverage cautiously, as it increases both potential profits and losses.