Exness Standard Accounts

The Exness Standard Accounts stand out as a popular choice among the variety of account types offered to cater to the diverse needs of traders globally. These accounts blend flexibility, accessibility, and a user-friendly trading environment, tailored to suit the needs of a wide range of traders, from beginners to experienced professionals.

Exness Standard Accounts offer competitive spreads, flexible leverage, and access to a wide array of trading instruments. They provide a straightforward and efficient trading experience, allowing traders to focus on their strategies without unnecessary complexities. With Exness’ reputation for reliability, transparency, and innovation in trading, the Standard Accounts are a reliable choice for traders looking for a dependable and uncomplicated platform.

What are Exness Standard Accounts

Exness Standard Accounts are designed to cater to a diverse range of traders, offering accessibility, competitive trading conditions, and a wide array of instruments.

Accessible Entry for Traders

Exness Standard Accounts provide an accessible entry point into the trading market, with a low minimum deposit requirement. This feature is particularly beneficial for novice traders or those starting with smaller investments.

Competitive Trading Conditions

One of the key highlights of Exness Standard Accounts is the competitive trading conditions. Traders enjoy tight spreads without additional commission fees, promoting cost-effectiveness in trading. The variable spread depends on market conditions, ensuring transparency and fair pricing.

Flexible Leverage Options

These accounts offer flexible leverage options, allowing traders to amplify their trading capacity. However, it’s important to understand the risks associated with higher leverage levels.

Diverse Trading Instruments

Exness Standard Accounts grant access to a broad range of trading instruments, including forex pairs, metals, cryptocurrencies, energies, and indices. This diversity enables traders to explore various markets and develop diversified trading strategies.

No Commission Fees

The absence of commission fees on Standard Accounts simplifies the cost structure for traders. Instead, all trading costs are included within the spread, making it easier to manage trading expenses.

Fast and Reliable Execution

Execution speed and reliability are paramount in trading, and Exness Standard Accounts excel in these areas. Traders benefit from rapid order execution, minimizing slippage risk, and ensuring trades are executed at optimal prices even in fast-moving markets.

Choice of Trading Platforms

Exness offers Standard Account holders the choice between MetaTrader 4 or MetaTrader 5 platforms. These platforms are renowned for their robustness, advanced charting tools, and user-friendly interfaces, enhancing the trading experience with powerful analytical tools and real-time data.

Excellent Customer Support

Exness is committed to providing excellent customer support to its Standard Account holders. Traders have access to timely assistance and resources to navigate their trading journey, addressing any queries or challenges they may encounter. This support builds a trusting relationship between the broker and clients, ensuring a positive and productive trading experience.

Types of Exness Standard Accounts

Exness offers different types of standard accounts to cater to the various needs and preferences of traders. Each account type is designed to offer specific features that align with different trading strategies, experience levels, and capital requirements.

Below is a table outlining the main types of Exness Standard Accounts, comparing their key features to help differentiate between them:

| Feature | Standard Account | Standard Cent Account |

| Minimum Deposit | Low | Very low |

| Account Currency | Multiple options | Primarily cents |

| Spread | Competitive | Competitive |

| Commission | No | No |

| Leverage | Flexible | Flexible |

| Trading Instruments | Wide range | Wide range |

| Execution | Fast | Fast |

| Trading Platform | MT4, MT5 | MT4, MT5 |

| Suitability | All traders | Novice traders |

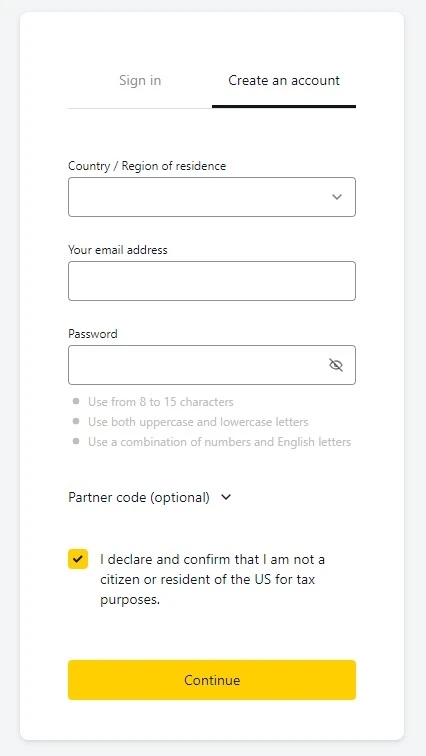

Opening an Exness Standard Account

Opening an Exness Standard Account is a straightforward process designed to be accessible and user-friendly. Here’s a step-by-step guide to help you through the process:

- Visit the Exness Website: Start by going to the Exness website. It’s important to ensure you’re visiting the official site to protect your personal information.

- Sign Up for an Account: On the Exness homepage, you’ll find an option to register or sign up. Click on this to start the account creation process. You’ll be asked to provide some basic information such as your email address and country of residence.

- Verify Your Email: After submitting your initial information, Exness will send a verification link to your email. Click on this link to verify your email address and continue the registration process.

- Complete the Registration Form: Once your email is verified, you’ll need to complete the registration form. This will include providing more detailed information about yourself, such as your full name, date of birth, and contact details.

- Pass the KYC Process: KYC (Know Your Customer) is a standard verification process where you’ll need to provide identification documents to verify your identity. This typically includes submitting a copy of your ID/passport and a recent utility bill or bank statement as proof of address.

- Choose Your Account Type: Select the Standard Account option. Depending on the platform, you might also need to choose between different types of Standard Accounts (e.g., Standard or Standard Cent).

- Make a Deposit: Once your account is set up and verified, you’ll need to fund it to start trading. Exness offers various deposit methods, including bank transfers, e-wallets, and credit cards. Choose the one that suits you best, and follow the instructions to make your deposit.

- Download the Trading Platform: While your account is being verified, you can download the trading platform you’ll use, such as MetaTrader 4 or MetaTrader 5. Exness allows you to access these platforms directly from its website.

- Start Trading: With your account funded and your trading platform installed, you’re now ready to start trading. It’s a good idea to begin with some practice trades or use a demo account to familiarize yourself with the platform and trading processes.

- Utilize Resources: Exness provides various educational resources and tools for traders. Take advantage of these to improve your trading knowledge and skills.

Benefits of Exness Standard Accounts

Exness Standard Accounts offer a range of benefits tailored to meet the needs of various traders, from beginners to experienced market participants. Here are some of the key advantages:

- Accessibility: Exness Standard Accounts have a low minimum deposit requirement, making them accessible for traders who don’t want to commit a large amount of capital upfront.

- Competitive Spreads: Exness offers competitive spreads, reducing the cost of trading and allowing traders to execute transactions at prices closer to market rates.

- No Commission: Standard Accounts come without commission fees, simplifying the cost structure for traders and making it easier to calculate profits and losses.

- Leverage Options: Traders can choose flexible leverage options according to their risk tolerance, although it’s important to use leverage wisely due to increased risks.

- Wide Range of Trading Instruments: Exness Standard Accounts provide access to various trading instruments like forex pairs, metals, cryptocurrencies, energies, and indices, enabling portfolio diversification.

- Advanced Trading Platforms: Exness offers MetaTrader 4 and MetaTrader 5 platforms, known for their user-friendly interfaces, advanced charting tools, and reliable functionality.

- Instant Execution: Exness ensures instant execution on trades, reducing delays and the risk of slippage, especially in fast-moving markets.

- 24/7 Customer Support: Traders have access to round-the-clock customer support in multiple languages, providing assistance whenever needed.

- Educational Resources: Exness offers a range of educational materials such as articles, webinars, and training courses to help traders improve their skills and knowledge.

- Demo Account: Traders can use a demo account to practice strategies and get familiar with the platform in a risk-free simulated trading environment, beneficial for beginners and strategy testing.

Overall, Exness Standard Accounts provide a comprehensive trading solution that balances ease of use with a range of features designed to support effective and efficient trading activities.

Account Management at Exness

Account management at Exness is designed to be straightforward and user-friendly, allowing traders to efficiently manage their funds, settings, and trading activities. Here are key aspects of account management that Exness offers to its clients:

- User Dashboard: Once you have an Exness account, you gain access to a user-friendly dashboard. This dashboard is your central hub for managing your accounts, viewing your balance, checking open positions, and monitoring your trading history.

- Deposits and Withdrawals: Exness provides a variety of options for depositing and withdrawing funds, including bank transfers, credit/debit cards, and e-wallets. The process is streamlined and designed for convenience, with many transactions processed instantly. Exness is known for its quick withdrawal process, which is a significant benefit for traders needing fast access to their funds.

- Account Verification: To comply with regulatory requirements, Exness requires account verification. This involves submitting identification documents, such as a passport or ID card, and proof of residence, like a utility bill or bank statement. The verification process is essential for ensuring the security and integrity of the trading environment.

- Leverage Adjustment: Traders have the flexibility to adjust their leverage based on their trading strategy and risk tolerance. Changing leverage can be done directly from the account settings, allowing traders to respond to changing market conditions or personal preferences.

- Account Types Switching: If a trader wishes to switch between different account types, for example, from a Standard to a Professional account, the process is typically straightforward. However, it’s essential to check the specific requirements and features of the new account type.

- Trading Platform Integration: Exness accounts are integrated with popular trading platforms like MetaTrader 4 and MetaTrader 5. Traders can easily connect their accounts to these platforms, enabling seamless trading and account management.

- Customer Support: Exness provides robust customer support for account management issues. Traders can access support through various channels, including live chat, email, and phone, ensuring they can resolve any issues promptly.

- Security Features: Account security is a top priority at Exness. The platform offers various security features, such as two-factor authentication (2FA), to protect traders’ accounts from unauthorized access.

- Customization and Preferences: Traders can customize their account settings according to their preferences, including setting up notifications, managing subscription services, and configuring other account features to suit their trading needs.

- Educational Resources and Tools: Exness offers various resources and tools to help traders manage their accounts more effectively, including educational content, analytical tools, and market insights.

By providing these comprehensive account management features, Exness ensures that traders can maintain control over their trading activities, customize their experience to suit their preferences, and access support and resources to enhance their trading success.

Financial Instruments Available with Exness Standard Accounts

Exness provides its clients with a wide array of financial instruments to trade, accommodating a variety of trading strategies and preferences. Here’s an overview of the key categories of financial instruments available through Exness Standard Accounts:

Forex:

As a major component of Exness’s offerings, forex trading allows clients to access a vast range of currency pairs, including major pairs, minor pairs, and exotic pairs. This variety enables traders to capitalize on the movements of different global currencies and engage in strategies like scalping, swing trading, or position trading.

Metals:

Traders can also engage in trading precious metals, which are often considered safe-haven assets. Exness provides access to metals such as gold and silver, allowing traders to speculate on their price movements or use them as a hedge against currency or market volatility.

Cryptocurrencies:

Recognizing the growing interest in digital assets, Exness offers trading on popular cryptocurrencies. This includes major cryptocurrencies like Bitcoin and Ethereum, providing traders an opportunity to delve into the dynamic crypto market.

Energies:

Traders interested in commodities can trade various energy products with Exness, such as oil and natural gas. These instruments are influenced by global economic factors, geopolitical events, and market supply-demand dynamics, offering diverse trading opportunities.

Indices:

Exness provides access to a range of global indices, allowing traders to speculate on the performance of specific sectors or the broader stock market across different countries. Trading indices can be a way to gain exposure to a country’s economic performance without having to trade individual stocks.

Stocks:

While typically not the primary focus in standard forex trading accounts, some platforms, including Exness, may offer trading on individual stocks or equities, enabling traders to speculate on the performance of major companies.

Commodities:

Beyond energies, traders might have the opportunity to trade other commodities like agricultural products or industrial metals, depending on the account and platform capabilities.

Conclusion

Exness Standard Accounts offer a versatile and accessible trading solution for a broad spectrum of traders, from beginners to experienced professionals. The streamlined and user-friendly account setup process ensures quick market engagement. With competitive spreads, zero commission fees, and flexible leverage options, these accounts provide a cost-effective and adaptable trading environment. The diverse range of financial instruments, including forex, metals, cryptocurrencies, energies, and indices, allows for portfolio diversification, risk management, and the ability to capitalize on various market opportunities. Overall, Exness Standard Accounts are a solid choice for those seeking a reliable and dynamic trading platform, providing the necessary tools, resources, and conditions to support traders at all stages of their journey.

Are there any commission fees on Exness Standard Accounts?

Exness Standard Accounts typically do not have commission fees on trades. Costs are incorporated into the spreads, making it easier for traders to manage and calculate their trading expenses.

What leverage is available on Exness Standard Accounts?

Exness offers flexible leverage options, which can be adjusted based on the trader's preference and risk management strategies. The available leverage can vary, so traders should verify the current options in their account settings or consult Exness's support for specifics.

Can I trade cryptocurrencies with an Exness Standard Account?

Yes, Exness provides the option to trade popular cryptocurrencies alongside traditional financial instruments like forex, metals, and more, depending on the account type and platform offerings.

How do I deposit funds into my Exness Standard Account?

Traders can deposit funds using various methods, including bank transfers, credit/debit cards, and e-wallets. The process typically involves logging into the Exness dashboard, selecting the deposit option, choosing the preferred payment method, and following the on-screen instructions.

Is there a demo account option for Exness Standard Accounts?

Yes, Exness offers a demo account feature, allowing traders to practice trading in a risk-free environment using virtual funds. This is particularly useful for beginners or those looking to test new strategies.