Exness Minimum Deposit

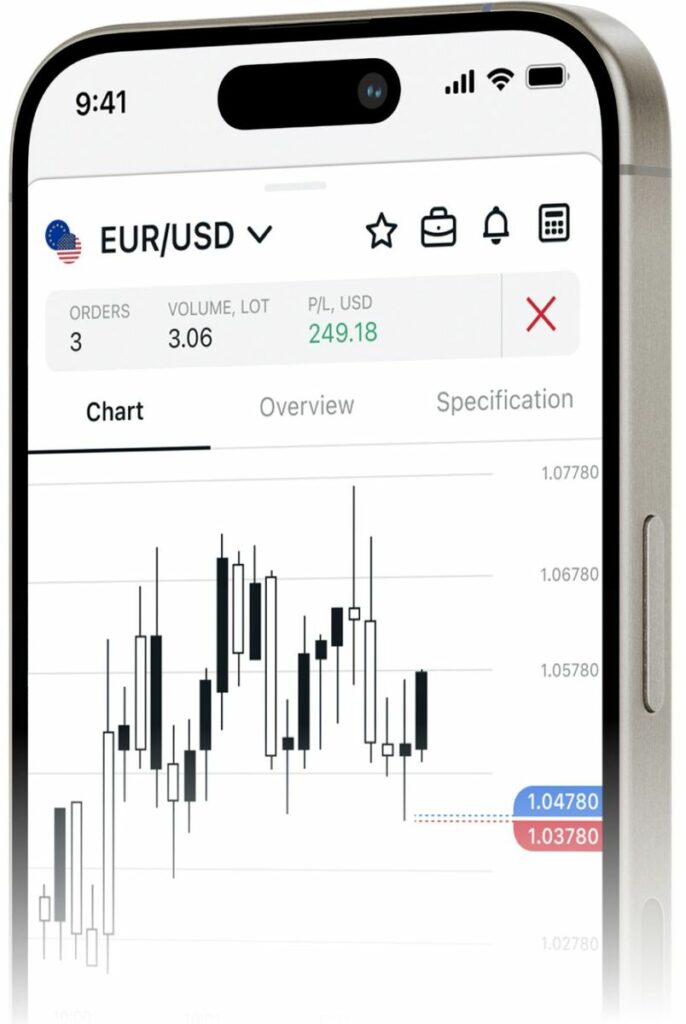

Recognized for its user-friendly approach, Exness provides flexible deposit requirements tailored to diverse traders, spanning from beginners to experts. This $1 initial deposit transcends mere financial exchange — it symbolizes the start of a trader’s voyage with the broker, molding their complete trading journey.

Understanding minimum deposit requirements is crucial as it impacts a trader’s capacity to manage risk, experiment with strategies, and explore the broker’s features without risking significant capital. For newcomers, a low minimum deposit serves as an appealing entry point into the forex realm, enabling them to acquire genuine market exposure beyond demo accounts. For experienced traders, it offers a chance to assess the broker’s services with a modest initial investment.

Understanding Exness Minimum Deposit

The minimum deposit is the smallest amount that Exness requires traders to deposit to start trading. This requirement varies depending on several factors, including the account type and the trader’s region. It’s designed to make trading accessible to a wide audience and can influence a trader’s choice of broker based on their financial capacity and trading strategy.

Exness Account Types and Their Minimum Deposits

Exness provides a variety of account types to cater to different trading styles, experience levels, and investment sizes. Each account type has its own set of features and corresponding minimum deposit requirements, allowing traders to select the one that best fits their needs. Here’s an overview of some common Exness account types and their minimum deposit requirements:

Standard Accounts:

- Standard Account: This account is well-suited for beginners and casual traders. It typically offers a very low minimum deposit, sometimes as little as $1, depending on the region and currency. The Standard Account is designed to be accessible, offering a straightforward trading experience without a significant financial barrier to entry.

- Standard Cent Account: Ideal for new traders who wish to trade with smaller amounts and manage risk more effectively. The minimum deposit is usually around the same as the Standard Account, making it an excellent choice for those who are new to trading or wish to test strategies with lower risk.

Professional Accounts:

- Raw Spread Account: Targeted at more experienced traders, this account type offers tighter spreads but might come with a higher minimum deposit. The minimum deposit could be around $200, although this can vary based on the trader’s region and selected currency.

- Zero Account: With no spread on most major currency pairs, the Zero Account is attractive for traders looking to minimize costs. The minimum deposit for this account might also be around $200.

- Pro Account: Designed for professional traders, the Pro Account offers more favorable trading conditions and access to a larger range of instruments. The required minimum deposit for a Pro Account is typically around $200 but could vary depending on the market conditions and Exness’s policy at the time.

Demo Account:

- While not a live trading account, it’s worth noting that Exness also offers Demo Accounts, which require no minimum deposit. These accounts are perfect for practicing trading strategies, getting familiar with the platform, and testing the waters without any financial commitment.

Other Factors Influencing Exness Minimum Deposit

When considering the minimum deposit at Exness, several factors come into play beyond the basic account requirements. These factors include:

- Regional Differences: Depending on the trader’s location, the minimum deposit requirements might vary due to regulatory environments and market conditions. Exness complies with regional financial regulations, which can influence these deposit requirements.

- Currency Impact: The minimum deposit amount can also depend on the selected account currency. Exness supports multiple currencies, and the equivalent minimum deposit in a local currency can vary due to exchange rates.

- Payment Methods: The choice of payment method can also affect the minimum deposit process. While Exness strives to offer low or no fees on deposits, the available methods (like bank transfers, e-wallets, and credit cards) might have their own minimum transfer amounts.

- Updates and Changes: It’s important to note that Exness periodically reviews and updates its policies, including minimum deposit requirements, to stay competitive and adapt to market changes. Traders should regularly check the Exness website or contact customer support for the most current information.

How to Make Minimum Deposit at Exness

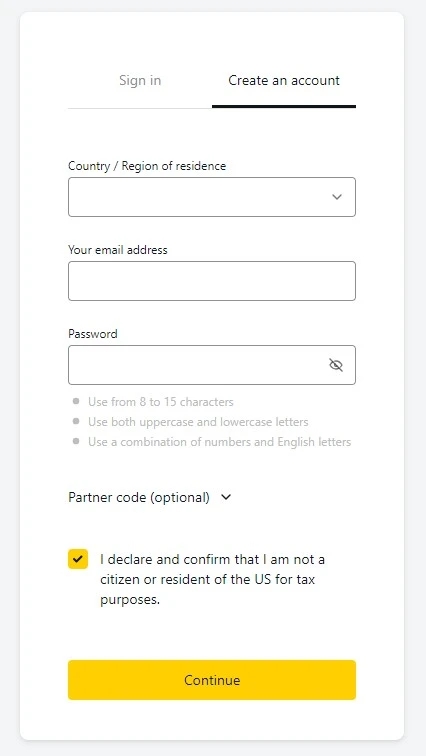

Making a minimum deposit with Exness is a straightforward process designed to facilitate quick and easy account funding. Here’s a step-by-step guide on how to deposit the minimum amount or more into your Exness trading account:

- Log In to Your Account: Access your Exness Personal Area by logging in on the Exness website or app. If you don’t have an account, you’ll need to create one and complete the necessary verification steps.

- Access the Deposit Section: Once logged in, navigate to the “Deposit” section within your Personal Area. This section is typically easy to find and prominently displayed.

- Select the Deposit Method: Choose your preferred payment method from the list of available options. These can vary based on your region, so select the one that suits your needs and availability in your country.

- Enter the Deposit Amount: Input the amount you wish to deposit. Ensure that it meets or exceeds the minimum deposit requirement for your specific account type. Remember, while you can deposit more than the minimum, you should never invest more than you can afford to lose.

- Fill in the Required Details: Depending on the chosen payment method, you may need to provide additional details or instructions. For example, credit card deposits would require card information, while bank transfers would need banking details.

- Confirm the Transaction: Review all the information to ensure it’s correct, then confirm the deposit. You may be redirected to your payment method’s platform (like an online banking portal or e-wallet) to complete the transaction.

- Check Your Account Balance: After making the deposit, it’s essential to check your Exness account balance to ensure the funds have been credited. This can usually be seen in your Personal Area.

- Start Trading: Once the funds are reflected in your account, you can start trading according to your trading plan and strategy.

Exness Payment Methods for Deposit

Exness provides its clients with a variety of payment methods to deposit funds into their trading accounts, catering to a global clientele with diverse preferences and requirements. The availability of these methods can vary based on the trader’s country of residence due to regional financial regulations and market practices. Here’s an overview of common payment methods offered by Exness for depositing funds:

- Bank Wire Transfers: Allows traders to transfer funds directly from their bank accounts to their Exness trading accounts. Generally reliable and secure, but the processing time can be longer compared to other methods.

- Credit and Debit Cards: Commonly used for their convenience and fast processing times. Exness typically supports major credit and debit cards, including Visa and Mastercard.

- E-Wallets: Provide fast and secure transactions. Popular e-wallet options include Neteller, Skrill, and WebMoney, among others, depending on the trader’s location.

- Cryptocurrency Payments: Some regions may have the option to deposit using cryptocurrencies like Bitcoin. Offers an alternative for those who prefer using digital currencies due to their low processing fees and quick transaction times.

- Local Payments: Exness may offer specific local payment methods tailored to the trader’s country, providing convenience and reducing conversion fees. These can include local bank transfers, mobile payment systems, and other region-specific options.

- Instant Bank Transfers: An option that allows traders to make quick deposits through their online banking, facilitating immediate trading opportunities.

Important Considerations:

- Fees: Exness strives to offer deposit methods with low or no fees. However, it’s crucial for traders to check if there might be any charges associated with their chosen payment method, either from Exness’s side or the payment service provider.

- Processing Times: While many deposit methods offer instant or near-instant processing, some, like bank wire transfers, may take several business days. Traders should consider the processing time to ensure funds are available when needed.

- Currency Conversion: If a deposit is made in a currency different from that of the trading account, a conversion will occur. Traders should be aware of the exchange rates and any potential conversion fees.

- Minimum and Maximum Limits: Each payment method may have its own minimum and maximum deposit limits. Traders should verify these details to ensure they align with their trading plans and account requirements.

- Security: Security is paramount when conducting financial transactions. Traders should ensure they use secure and encrypted methods to protect their funds and personal information.

Benefits of Exness Low Minimum Deposit

Exness’s low minimum deposit requirement offers several advantages, making it an attractive choice for various types of traders. Here are some key benefits:

Accessibility for Beginners:

The low entry barrier allows novice traders to start trading without the need for a substantial initial investment. This accessibility helps beginners to experience real market conditions without risking large amounts of money, providing a practical learning environment alongside demo accounts.

Risk Management:

Traders can better manage their risks by depositing small amounts. This is particularly beneficial for those who are still learning or wish to test different trading strategies without significant financial exposure.

Testing the Broker’s Platform:

A low minimum deposit enables traders to explore and evaluate Exness’s trading platform, customer service, and overall trading environment with minimal financial commitment. This firsthand experience can be invaluable when deciding whether to increase investments with the broker.

Diversification:

Traders with limited capital can diversify their investments across different financial instruments or trading strategies, spreading their risk. Exness’s low deposit requirement facilitates this diversification by not tying up significant funds in a single trading account or instrument.

Flexibility in Trading:

A low minimum deposit gives traders the flexibility to adjust their trading volume and leverage according to their comfort level and market conditions. This flexibility can be particularly advantageous in rapidly changing markets.

Encourages Continuous Trading:

Even if a trader faces losses, the low minimum deposit requirement makes it easier to replenish the account and continue trading, allowing for persistence and the opportunity to learn from trading experiences.

Global Inclusivity:

By offering low minimum deposits, Exness makes it possible for individuals from various economic backgrounds and regions to participate in the global trading market, promoting financial inclusivity.

Experimentation with New Markets:

Traders can use minimal funds to explore and learn about new financial markets or instruments, expanding their trading expertise and potential opportunities.

Summary

Exness’s minimum deposit requirement, starting as low as $1, reflects its commitment to inclusivity and accessibility in the trading world. This modest investment opens doors for traders, offering them the chance to enter the market with minimal risk and explore Exness’s account types and features. The flexibility of these low deposits empowers traders to manage risk effectively, test strategies, and evaluate the platform without significant financial commitment.

Exness’s low minimum deposit encourages traders worldwide to participate in the market, fostering a culture of learning and continuous improvement. Whether it’s ease of entry for beginners or diversification opportunities, Exness’s approach benefits traders and contributes to a more vibrant trading community globally.

Does the minimum deposit vary between different Exness account types?

Yes, the minimum deposit amount can vary significantly between different account types at Exness. Standard accounts typically have lower minimum deposit requirements compared to Professional accounts.

Can I deposit a currency different from my account currency?

Yes, you can deposit in a different currency. Exness will automatically convert the funds to your account's currency, although you should be aware of potential conversion fees or rate differences.

Are there any fees for depositing into an Exness account?

Exness aims to offer fee-free deposits for most payment methods. However, it's advisable to check for any potential fees associated with your chosen deposit method or currency conversion.

How long does it take for a deposit to be credited to my Exness account?

The processing time for deposits can vary depending on the payment method. Many methods like credit/debit cards and e-wallets offer instant deposits, while bank transfers may take several business days.

Can I change my deposit method after creating an account?

Yes, you can choose different deposit methods for subsequent deposits. However, for security reasons, it's crucial to use methods that are in your name and follow the verification procedures required by Exness.