Exness Islamic Account

Among its specialized offerings, the Exness Islamic Account is a significant feature designed to cater to Muslim traders, adhering to the principles of Islamic finance. Islamic accounts, also known as swap-free accounts, are structured in compliance with Sharia law, which prohibits the accrual of interest.

This type of account eliminates the swap or rollover interests on overnight positions, a feature that aligns with the ethical and religious mandates followed by Muslim traders. The Exness Islamic Account ensures that trading activities do not conflict with Islamic finance principles, providing a platform for faith-based trading without compromising on the advanced features and competitive conditions Exness is known for.

By integrating such ethical considerations into its service offerings, Exness demonstrates its commitment to inclusivity and respect for cultural and religious values in the financial sector.

Definition of Exness Islamic Account

The Exness Islamic Account refers to a specialized trading account provided by Exness, a well-known forex and CFD broker, designed to comply with the principles of Islamic finance. This type of account is specifically tailored to meet the needs of Muslim traders who wish to engage in forex trading without contravening the Sharia law, which prohibits any form of interest (Riba).

Characteristics of an Exness Islamic Account include:

- Swap-Free: Unlike conventional trading accounts, Islamic accounts at Exness do not incur swap or rollover interest on positions held overnight, aligning with the Islamic prohibition of interest.

- No Hidden Fees: To ensure transparency and fairness, Exness Islamic Accounts are structured to avoid any hidden charges or fees that could be considered Riba, ensuring traders can participate in the market without compromising their religious beliefs.

- Compliance with Sharia Law: These accounts are meticulously designed to adhere to Islamic financial principles, providing a platform where traders can invest and trade while adhering to their ethical and religious standards.

- Equal Trading Conditions: Exness ensures that the trading conditions for Islamic accounts are on par with their conventional counterparts, offering the same levels of service, spreads, and trading opportunities without the interest component.

Exness Islamic Account provides a solution for Muslim traders to participate in the financial markets in a way that is consistent with their religious beliefs, ensuring they can trade without facing ethical dilemmas related to interest-based financial activities.

Features of Exness Islamic Account

The Exness Islamic Account comes with a set of distinctive features designed to align with the principles of Islamic finance while providing a robust trading experience. Here are the key features of the Exness Islamic Account:

- Swap-Free Trading: One of the hallmark features of the Exness Islamic Account is its swap-free status. This means that traders will not be charged or receive any swap or rollover interest on positions they hold overnight, which is a critical requirement for compliance with Islamic finance principles.

- No Commission on Islamic Accounts: To ensure full compliance with Sharia law, which prohibits not just interest but any form of unjustified earnings, Exness Islamic Accounts are typically free from any commission charges that could be viewed as hidden interest.

- Instant Access to Trading: Like its conventional counterparts, the Exness Islamic Account offers instant access to trading, allowing traders to engage with the market in real-time without delays, ensuring they do not miss out on crucial market movements.

- Access to All Trading Instruments: Traders using the Exness Islamic Account have access to the same wide range of trading instruments available to standard account holders. This includes forex pairs, metals, cryptocurrencies, energies, and indices, providing a comprehensive trading experience.

- Transparent Pricing: Ensuring transparency in all transactions, Exness Islamic Accounts provide clear, upfront pricing without hidden fees or charges, aligning with the ethical trading principles valued in Islamic finance.

- Leverage Options: Traders can access various leverage options, just like in conventional accounts, allowing them to choose the level of risk and potential reward they are comfortable with, in accordance with their trading strategies and capital.

- Dedicated Support: Exness provides dedicated support for users of its Islamic accounts, ensuring they have the necessary resources and assistance to trade effectively and in accordance with their religious beliefs.

- Easy Conversion: For existing Exness clients, converting a standard trading account into an Islamic account is typically straightforward, involving a simple request process through the client’s personal area or direct assistance from customer support.

How Open Exness Islamic Account

Opening an Exness Islamic Account involves a straightforward process that aligns closely with the standard procedure for opening an Exness account, with an additional step to convert it into an Islamic format. Here’s a step-by-step guide to help you open an Exness Islamic Account:

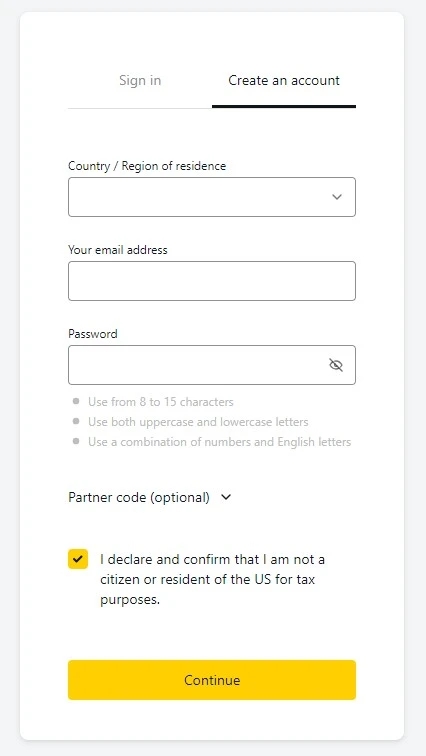

- Register with Exness:

- Visit the Exness website and initiate the registration process.

- Fill out the registration form with your personal details, including your name, email address, and any other required information.

- Account Verification:

- To comply with financial regulations, you’ll need to verify your identity and residence.

- Upload the necessary documents, typically including a government-issued ID and a recent utility bill or bank statement for address verification.

- Open a Trading Account:

- Once your Exness account is verified, you can open a new trading account.

- Choose the account type that best fits your trading style and requirements.

- Request Islamic Account Conversion:

- Contact Exness support through your Personal Area to request the conversion of your newly created trading account into an Islamic Account.

- This process usually involves filling out a form or simply making a request through the platform or via email.

- Wait for Approval:

- Exness will review your request to ensure it meets the criteria for an Islamic Account.

- This process may take some time, and you might be required to provide additional information or documentation.

- Confirmation:

- Once your account conversion is approved, you will receive a confirmation from Exness.

- Your trading account will then be classified as an Islamic Account, removing all swap fees in accordance with Islamic finance principles.

- Begin Trading:

- With your Islamic Account now active, you can start trading across various markets available on Exness without worrying about incurring swap fees.

- Continuous Support:

- If you have any questions or require further assistance, Exness provides customer support to guide you through any aspect of your Islamic Account.

It’s important to review all terms and conditions related to the Islamic Account to ensure it aligns with your trading strategy and religious requirements. Additionally, staying informed about any potential changes in policy or account features will help you maintain compliance and make the most of your trading experience with Exness.

Benefits of Using an Exness Islamic Account

The Exness Islamic Account offers several benefits, making it an attractive choice for Muslim traders who wish to adhere to Sharia principles while engaging in forex and CFD trading. Here are some of the key benefits of using an Exness Islamic Account:

- Sharia Compliance: The primary benefit of the Exness Islamic Account is its compliance with Islamic finance principles. By eliminating swap or rollover interest on overnight positions, it ensures that Muslim traders can engage in trading activities without violating the prohibition of Riba (interest).

- Transparent Trading Conditions: Exness is known for its transparency, and the Islamic Account is no exception. Traders have clear visibility on all trading conditions, fees, and potential charges, ensuring there are no hidden costs, which is crucial for maintaining trust and ethical standards in line with Islamic principles.

- Equal Opportunities: Traders using an Islamic Account have access to the same range of markets and trading instruments as those using standard accounts. This means that being Sharia-compliant does not limit a trader’s ability to participate in various financial markets, from forex to commodities and indices.

- No Financial Penalties: The absence of overnight interest charges means that traders can hold positions open for an extended period without incurring additional costs. This is particularly beneficial for traders who employ long-term trading strategies.

- Access to All Trading Platforms: Exness Islamic Account holders can use all the trading platforms offered by Exness, including MetaTrader 4 and MetaTrader 5. This provides flexibility and choice in terms of trading interfaces and tools.

- Leverage and Margin: Like standard accounts, Islamic Accounts at Exness offer various leverage options, allowing traders to choose their preferred level of risk and potential return. The margin requirements are clearly stated, helping traders to make informed decisions.

- Customer Support: Exness provides dedicated support for its Islamic Account users, ensuring that they can get assistance whenever needed. Whether it’s account setup, trading queries, or technical support, traders can rely on timely and effective help.

- Ethical Trading: For many Muslim traders, the biggest benefit is the ability to trade in a manner that aligns with their ethical and religious beliefs. Knowing that their trading activities do not contravene their faith can provide significant peace of mind and satisfaction.

Eligibility and How to Apply Exness Islamic Account

Eligibility for an Exness Islamic Account typically aligns with the broker’s general account opening requirements, with the additional consideration of the account’s compliance with Islamic finance principles.

Eligibility Criteria:

- Compliance with Exness Account Opening Requirements: Applicants must meet the standard Exness criteria for opening an account, which usually includes being of legal age to trade and providing the necessary identification documents to verify one’s identity and residence.

- Religious Consideration: The Islamic Account is specifically designed for traders who need to comply with Islamic finance principles. While primarily catered to Muslim traders, the account is available to anyone seeking to trade without earning interest.

- Jurisdictional Approval: Applicants must reside in a country where Exness operates and where Islamic accounts are available, adhering to the local laws and regulations governing financial trading and Islamic finance.

How to Apply:

- Sign Up or Log In: If you’re new to Exness, you will need to create an account. Existing users can log in to their Exness Personal Area.

- Account Verification: Complete the necessary KYC (Know Your Customer) process, which involves submitting identification documents such as a passport or ID card and proof of residence.

- Request an Islamic Account: Once your standard account is set up and verified, you can request to convert it into an Islamic Account. This can usually be done from the Personal Area on the Exness website or by contacting customer support directly.

- Confirmation and Setup: Exness will review your request for an Islamic Account. Once approved, your trading account will be adjusted to reflect the swap-free status. You’ll receive confirmation and can then begin trading under the conditions of the Islamic Account.

- Start Trading: With your Islamic Account active, you can start trading on the Exness platform, accessing various markets and instruments without concern for swap rates.

Comparison with Conventional Trading Accounts

Comparing Exness Islamic Accounts with conventional trading accounts highlights key differences primarily centered around compliance with Islamic finance principles. Here’s a detailed comparison on various aspects:

Interest on Overnight Positions (Swap):

- Islamic Account: There are no swap fees or rollover interests on overnight positions, adhering to Sharia law’s prohibition of Riba (interest).

- Conventional Account: These accounts typically charge or credit interest on positions held overnight, based on the differential interest rates of the traded currencies.

Commission and Fees:

- Islamic Account: While Islamic accounts are free from swap fees, they might have other types of charges, such as administration fees, but these are not related to interest and are fully disclosed to the trader.

- Conventional Account: Besides swap fees, conventional accounts might include commissions or spreads, which can vary based on the account type and market conditions.

Trading Instruments:

- Islamic Account: Traders have access to the same wide range of trading instruments as conventional accounts, including forex, commodities, indices, and more.

- Conventional Account: Offers full access to all trading instruments provided by Exness, with no restrictions based on account type.

Account Types and Conditions:

- Islamic Account: Exness allows the conversion of various account types to Islamic accounts, maintaining the same core trading conditions except for the absence of swaps.

- Conventional Account: These accounts come in various types, like Standard and Pro, each with specific conditions regarding spreads, leverage, and minimum deposits.

Leverage:

- Islamic Account: The leverage options available for Islamic accounts are typically similar to those in conventional accounts, allowing traders to choose based on their risk appetite and trading strategy.

- Conventional Account: Offers a range of leverage options, which can be selected according to the trader’s preference and experience level.

Market Execution and Pricing:

- Islamic Account: Islamic accounts offer the same instant market execution as conventional accounts, ensuring timely trades without re-quotes.

- Conventional Account: Provides real-time execution with competitive pricing, depending on the account type and market conditions.

Transparency and Fairness:

- Islamic Account: These accounts emphasize transparency and fairness, ensuring traders are fully aware of all applicable fees and conditions without any hidden charges.

- Conventional Account: Transparency is also a key feature, with all potential costs and trading conditions clearly stated upfront.

The primary difference between Exness Islamic accounts and conventional accounts lies in the handling of swap fees, aligning Islamic accounts with Sharia law. Other aspects, like trading conditions, market access, and execution, are designed to ensure that Islamic account holders enjoy a trading experience that is equitable and competitive with conventional accounts.

Conclusion

Exness Islamic Accounts provide a comprehensive trading solution for Muslim traders and others seeking to engage in forex and CFD trading without incurring swap fees, in alignment with Islamic finance principles. These accounts offer the key advantage of compliance with Sharia law, ensuring that traders can participate in the financial markets without compromising their ethical or religious beliefs.

The core feature distinguishing Islamic accounts from conventional ones is the absence of overnight interest, yet Exness ensures that this does not diminish the trading experience. Islamic account holders benefit from the same range of trading instruments, market access, and technological features as their conventional counterparts, ensuring a competitive and fair trading environment.

How does an Exness Islamic Account differ from a regular trading account?

The key difference lies in the absence of swap fees in Islamic accounts. Regular accounts typically charge or credit swap fees for positions held overnight, which is not permissible under Islamic law. Islamic accounts might have other fee structures but do not include interest-based charges.

Who can open an Exness Islamic Account?

While designed for Muslim traders to comply with Sharia law, Exness Islamic Accounts are available to any trader who prefers not to engage in interest-based trading. Applicants must meet the general Exness eligibility criteria to open an account.

Are there any additional fees in Exness Islamic Accounts?

Islamic accounts may have administrative fees or commission charges but do not include swap fees. Any additional costs will be transparently communicated, ensuring traders are fully informed about their account conditions.

How can I convert my existing Exness account to an Islamic Account?

You can request the conversion of your existing account to an Islamic Account through your Exness Personal Area or by contacting Exness customer support. The process typically involves a simple request and confirmation from the broker.

Can I access all trading instruments with an Exness Islamic Account?

Yes, Islamic Account holders have access to the same wide range of trading instruments available to standard account holders, including forex, commodities, indices, and more.