Exness Deposit and Withdrawal

At Exness, we pride ourselves on providing a user-centric platform where deposit and withdrawal operations are designed to be swift, secure, and straightforward. Catering to a global clientele, Exness offers a multitude of payment methods, ensuring that users from diverse geographies can transact with ease.

Currencies Available at Exness

Exness supports a wide range of account currencies to accommodate traders globally, offering accessibility and convenience with diverse payment methods including popular e-payment systems and traditional banking options. However, users should be mindful of the risks associated with CFD trading, particularly the leverage’s potential to amplify gains and losses. The accepted currencies at Exness include ARS, AED, AZN, AUD, BND, BHD, CHF, CAD, CNY, EUR, EGP, GHS, GBP, HUF, HKD, INR, IDR, JPY, JOD, KRW, KES, KWD, KZT, MXN, MAD, MYR, NZD, NGN, OMR, PKR, PHP, SAR, QAR, RHB, SGD, UAH, USD, UGX, UZS, XOF, VND, and ZAR.

For funding accounts, Exness accepts electronic currencies such as Perfect Money (USD), WebMoney (USD, EUR), Neteller (USD, EUR), and Skrill (USD, EUR). Additionally, Exness supports a variety of cryptocurrencies including Bitcoin, Ethereum, Litecoin, Ripple, Bitcoin Cash, Stellar, Tether, Dash, Monero, Zcash, Bitcoin Gold, Ethereum Classic, NEM, NEO, OmiseGO, Qtum, TRON, USD Coin, and PAX Gold. This broad selection of options allows users to tailor their trading experience to their preferences and needs.

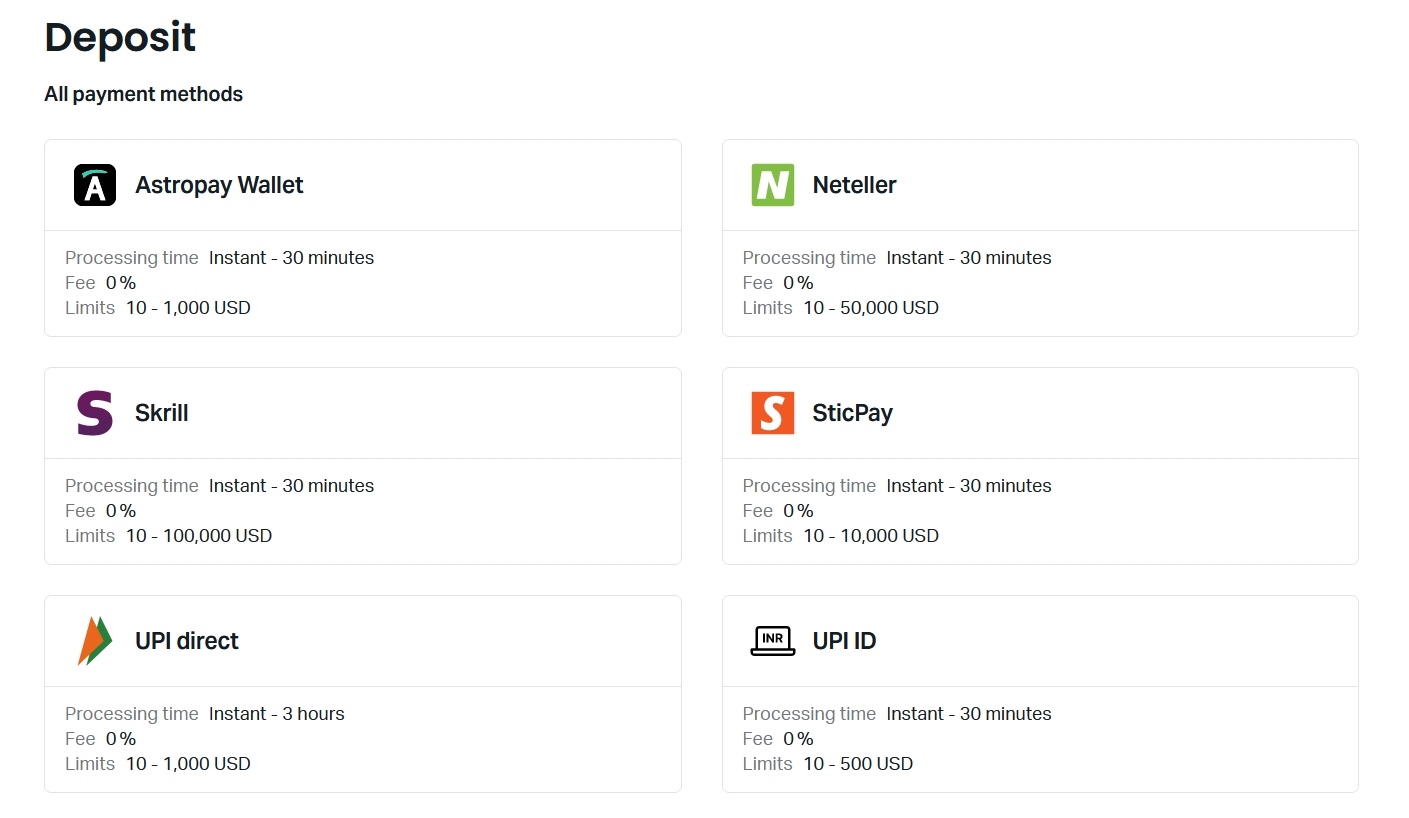

Exness Deposit Methods

Exness provides its users with a variety of deposit methods to fund their trading accounts, catering to the diverse needs and preferences of its global clientele. Understanding the available deposit options, their processing times, and any potential fees is crucial for efficient account management. Here’s an overview of the common deposit methods offered by Exness, along with guidance on how to use them:

Bank Wire Transfer:

- Description: A traditional and secure method to transfer funds directly from your bank account to your Exness trading account.

- Processing Time: It may take 3-5 business days for the funds to be reflected in your account.

- Fees: Exness does not charge any fees for bank wire deposits, but your bank might impose transaction fees.

Credit/Debit Cards:

- Description: Use your Visa or MasterCard to make instant deposits into your Exness account.

- Processing Time: Deposits are usually instant, allowing you to start trading without delay.

- Fees: There are typically no Exness fees for card deposits, but it’s advisable to check if your card issuer charges any additional fees.

E-Wallets:

- Options: Exness supports various e-wallets like Neteller, Skrill, and WebMoney, among others.

- Processing Time: Deposits through e-wallets are instant, providing quick access to trading funds.

- Fees: No Exness fees for e-wallet deposits, but the e-wallet provider might have transaction fees.

Cryptocurrencies:

- Description: Exness allows deposits in various cryptocurrencies, offering an innovative and fast way to fund your account.

- Processing Time: Cryptocurrency deposits are usually processed within a few minutes to a few hours, depending on the blockchain network.

- Fees: No Exness fees for cryptocurrency deposits, but network fees apply and can vary based on the cryptocurrency used.

Local Payment Methods:

- Description: Depending on your region, Exness may offer local payment options that align with local banking practices and preferences.

- Processing Time: Most local payment methods provide instant or near-instant deposit times.

- Fees: Exness strives to offer fee-free deposits, but it’s best to verify if any local payment method incurs additional charges.

Selecting the right deposit method depends on your personal preferences, the urgency of the funds, and the potential costs involved. By offering a range of deposit options, Exness ensures that traders can fund their accounts conveniently and securely, enabling them to engage with the markets effectively. Always consider the processing times and any associated fees to plan your trading activities and financial management efficiently.

How to Make Deposit at Exness:

- Log in to Your Account: Access your Exness personal area.

- Select ‘Deposit’: Find and click on the ‘Deposit’ option.

- Choose Your Deposit Method: Select the preferred deposit method from the list available to you.

- Enter the Amount: Specify the amount you wish to deposit and fill in any required information related to the chosen deposit method.

- Confirm the Transaction: Follow the prompts to confirm your deposit and, if necessary, complete any verification steps required by your payment method.

- Check Your Account Balance: Once the deposit is processed, verify that the funds are reflected in your Exness account balance.

Exness Withdrawal Methods

Exness is committed to providing a seamless withdrawal experience for its users, ensuring that traders can access their funds conveniently and efficiently. The platform offers various withdrawal methods, each designed to meet the diverse needs of its global user base. Understanding these methods, along with their respective processing times and fees, is vital for effective account management. Here’s an overview of the key withdrawal options available at Exness:

Bank Wire Transfer:

- Description: A reliable method for transferring your funds directly to your bank account.

- Processing Time: Withdrawals can take anywhere from 3-5 business days, depending on your bank’s processing times.

- Fees: Exness does not impose fees on bank wire withdrawals, but your bank may charge a transaction fee.

Credit/Debit Cards:

- Description: Withdraw funds directly to the credit or debit card you used for depositing.

- Processing Time: Typically, card withdrawals are processed within 3-5 business days, although the exact time can vary based on the card issuer.

- Fees: No Exness fees for card withdrawals, but be aware of any potential fees your card issuer might apply.

E-Wallets:

- Options: Withdraw your funds to e-wallets like Neteller, Skrill, or WebMoney for a quick and convenient process.

- Processing Time: E-wallet withdrawals are usually instant, although they can take up to a few hours in some cases.

- Fees: No Exness fees for withdrawing to e-wallets, but check if the e-wallet provider charges any service fees.

Cryptocurrencies:

- Description: Exness allows you to withdraw funds in cryptocurrencies, offering a modern and efficient withdrawal method.

- Processing Time: Cryptocurrency withdrawals are typically processed within a few hours, depending on the network speed and congestion.

- Fees: There are no Exness fees for cryptocurrency withdrawals, but standard blockchain network fees apply.

Local Payment Methods:

- Description: Depending on your location, you may have access to local payment methods that align with your regional banking practices.

- Processing Time: Most local payment methods offer quick withdrawal times, often within the same day or the next business day.

- Fees: While Exness aims to provide fee-free withdrawals, it’s advisable to check for any potential charges associated with local payment methods.

The variety of withdrawal methods at Exness ensures that traders can access their funds in a way that suits their preferences and needs. It’s important to consider the processing times and any associated fees when planning your withdrawals. By offering straightforward and secure withdrawal processes, Exness facilitates a trustworthy and efficient trading environment for its users.

How to Request a Withdrawal at Exness:

- Log in to Your Account: Access your Exness personal area.

- Select ‘Withdrawal’: Navigate to the ‘Withdrawal’ section.

- Choose Your Withdrawal Method: Pick the method you prefer or the one you used for depositing (if applicable).

- Enter the Withdrawal Amount: Specify how much you wish to withdraw and provide any required information for the chosen method.

- Confirm the Transaction: Follow the on-screen instructions to confirm your withdrawal request.

- Receive Your Funds: Once processed, the funds will be transferred to your chosen withdrawal destination.

Security Measures of Exness Payment Process

Exness takes the security of its clients’ funds and data very seriously, employing a range of robust measures to ensure a secure trading environment. The platform is designed to protect against various security threats and to provide traders with peace of mind. Here’s an overview of the key security measures implemented by Exness.

Regulatory Compliance:

- Exness is regulated by several financial authorities, ensuring it adheres to strict standards of financial stability and ethical business practices. These regulations mandate the implementation of stringent security protocols.

- Regular audits by independent auditors confirm the integrity and reliability of Exness’s financial and operational processes.

Data Encryption:

- The Exness platform uses advanced SSL (Secure Socket Layer) encryption to protect user data during transmission. This ensures that personal and financial information is securely encrypted when communicated over the internet.

- Additionally, secure encryption protocols are in place to safeguard the data stored on Exness servers, preventing unauthorized access.

Two-Factor Authentication (2FA):

- Exness offers two-factor authentication, providing an extra layer of security for client accounts. 2FA requires users to verify their identity using two different methods, typically a password and a code sent to their mobile device, before accessing their account or processing transactions.

Account Monitoring and Alerts:

- Continuous monitoring of account activity allows Exness to detect and respond to unusual or suspicious behavior swiftly. This helps in preventing unauthorized access and potential fraud.

- Clients receive notifications of important account activities, such as login attempts, password changes, and withdrawal requests, enabling them to stay informed and react promptly to any irregularities.

Client Fund Segregation:

- Exness segregates clients’ funds from its own operational funds, storing them in separate accounts with top-tier banks. This ensures that client money is protected and can only be used for their trading activities, not for the company’s operational expenses.

- In the unlikely event of financial instability at Exness, segregated funds remain protected and cannot be used to pay back creditors.

Risk Management:

- Exness employs comprehensive risk management strategies to mitigate financial risks associated with trading. This includes providing negative balance protection, ensuring clients cannot lose more money than they have deposited in their trading accounts.

User Education and Support:

- Exness provides its users with educational resources and guidelines on how to maintain the security of their accounts and recognize phishing attempts or fraudulent activities.

- A dedicated support team is available to assist with any security concerns, offering guidance and immediate assistance to address potential security issues.

Through its adherence to regulatory standards, implementation of advanced technology, and commitment to client education, Exness establishes a secure and reliable trading environment. These security measures are crucial in maintaining the trust and loyalty of its users, enabling them to focus on their trading activities without undue concern over the safety of their funds and personal information.

Conclusion

Exness is a leading trading platform known for its reliability and user-friendly approach, focusing on seamless user experience, security, and exceptional customer support. With meticulous registration processes, various deposit and withdrawal options, and stringent security measures, Exness ensures user convenience and financial safety. Its diverse user support services, including 24/7 customer assistance, multilingual support, and educational resources, cater to a global user base. From beginners to professionals, Exness offers a comprehensive trading solution, prioritizing user security, flexible transactions, and dedicated customer support. Traders can confidently manage funds, understand market dynamics, and explore opportunities in Exness’ secure and user-friendly environment, making it the preferred choice for many.

How quickly are my deposits processed at Exness?

The processing time for deposits at Exness depends on the chosen method. Credit/debit card and e-wallet deposits are typically instant, while bank wire transfers may take several business days. Cryptocurrency deposits usually take a short time, contingent on the blockchain network's speed.

Are there any fees charged by Exness for making a deposit or withdrawal?

Exness prides itself on offering fee-free deposits and withdrawals for most methods. However, it's important to note that some payment systems or banks might impose their own fees, which are not under Exness's control.

How do I withdraw funds from my Exness account, and what are the steps involved?

To withdraw funds, log into your Exness Personal Area, select 'Withdrawal,' choose your preferred withdrawal method, specify the amount, and follow the instructions to complete the transaction. Withdrawal methods are generally similar to deposit options, including bank transfers, credit/debit cards, e-wallets, and more.

What is the typical processing time for withdrawals at Exness?

Withdrawal times vary; e-wallets are often processed within a few hours, while bank transfers and credit/debit card withdrawals may take several business days. Processing times for cryptocurrencies depend on the network's current traffic.

How can I ensure that my deposits and withdrawals are processed smoothly at Exness?

Ensure that all your account verification documents are up to date, follow the deposit and withdrawal guidelines as per Exness's policy, and double-check your payment details before submitting any transaction. In case of any discrepancies or issues, contact Exness's customer support immediately for assistance.